Industries

Financial Services

|

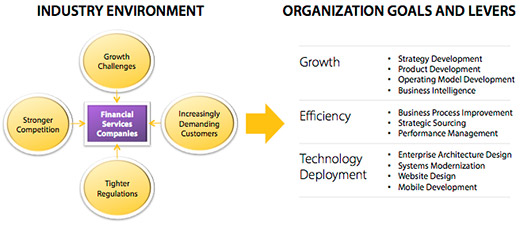

As Global Markets tread a fine line between recovery and the drag of paying down excess debt, to succeed in the current economic environment financial services companies face tremendous challenges. They must manage traditional and emerging risks, achieve operational excellence and comply with complex regulatory requirements – all while meeting the competing interests of a diverse group of stakeholders and rebuilding customer trust. The robust growth in banking and financial services can be ensured with operational efficiency and scale of operations. Both these can be achieved with the deployment of latest technology, training and single point of contact for service delivery that enhances customer satisfaction. The banking operations are witnessing rapid changes all over the world and the updated solutions are going to ensure that the customers are more likely to enjoy the benefits with the adoption of changes. |

|

|

Ebyte’s financial services consulting team understands these challenges and their impact on financial institutions in the banking, asset management and insurance sectors. Our financial services consultants combine practical industry knowledge with operations, technology, risk and regulatory strategy expertise honed through direct experience working with clients in all sectors and of all sizes. We bring a refreshing and pragmatic approach to financial services consulting that is focused on delivering results. |

|